Building lifetime relationships with a knowledgeable and trusted advisory team

A Mindful Approach to Multi-Generational Wealth

Founded in 2007 as an independent boutique wealth management firm in New York City, Satovsky Asset Management is dedicated to creating and preserving multi-generational wealth. Our approach goes beyond the traditional wealth advisory relationship by offering a level of alignment and personalized service that treats our clients as family.

We uphold the highest standards of fiduciary duty, taking your financial success personally. Our hyper-personalized approach combines financial planning, investment management, and behavioral coaching to foster investor habits and strategies that ensure long-term abundance and peace of mind for generations to come.

Bringing Together Diverse Skillsets And Expertise To Serve You

At Satovsky, we understand that your needs are unique, and your time is priceless. Your trust and satisfaction are paramount. Our motto: “If we wouldn’t recommend something to our own loved ones, don’t recommend it to our clients.”

Our team of diverse professionals comes together to offer cutting-edge strategies, technical expertise, and a genuine passion for enhancing lives.

Our mission? To help you achieve a lifetime of joy and abundance. Join us, and let’s build a brighter future together.

Questions? We know your time is valuable, We promise not to waste it.

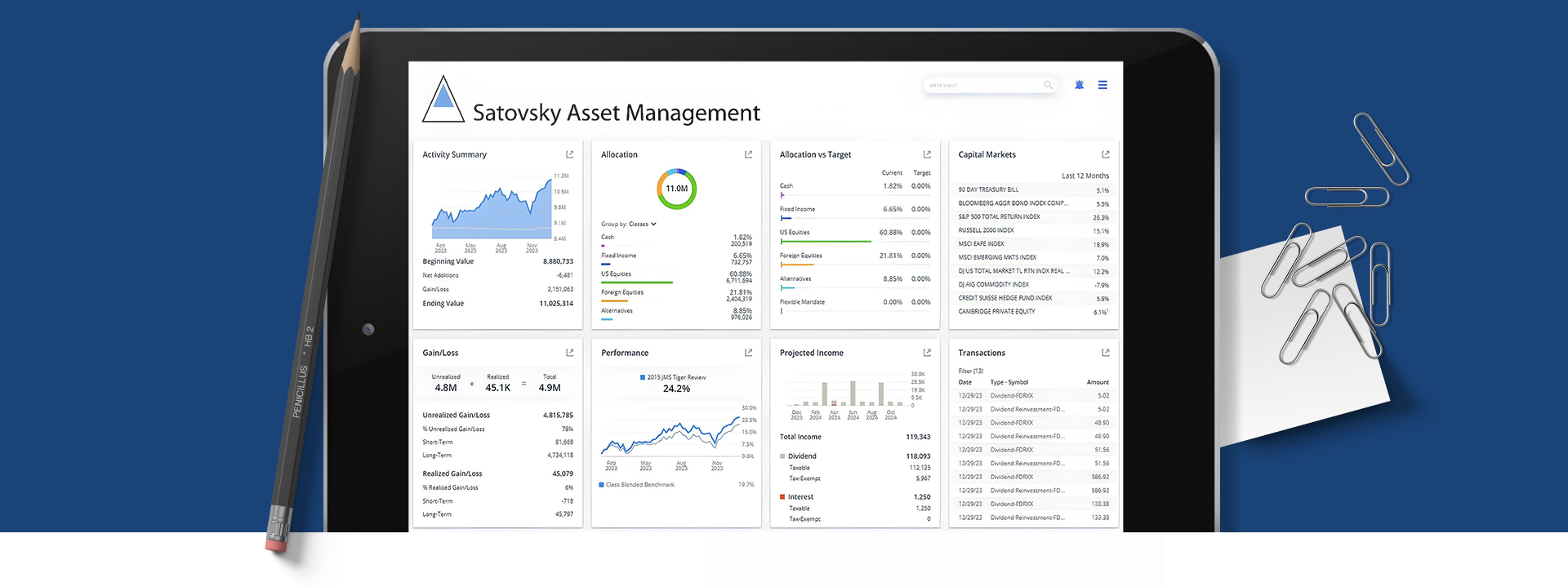

Combining Human Experience and Talent

With The Latest In Digital Technology

Committed To Fiduciary Excellence

Research

Driven by evidence-based research, our tailored portfolio solutions bring your interests into alignment with the latest in science, technology and academia.

Meaningful Relationships

Here, everyone is treated like family. Our goal is to create deep and life-long connections founded on trust, honesty, and a bond that surpasses the typical relationship between a financial advisor and client.

Continued Education

Driven by evidence-based research, our tailored portfolio solutions bring your interests into alignment with the latest in science, technology and academia.

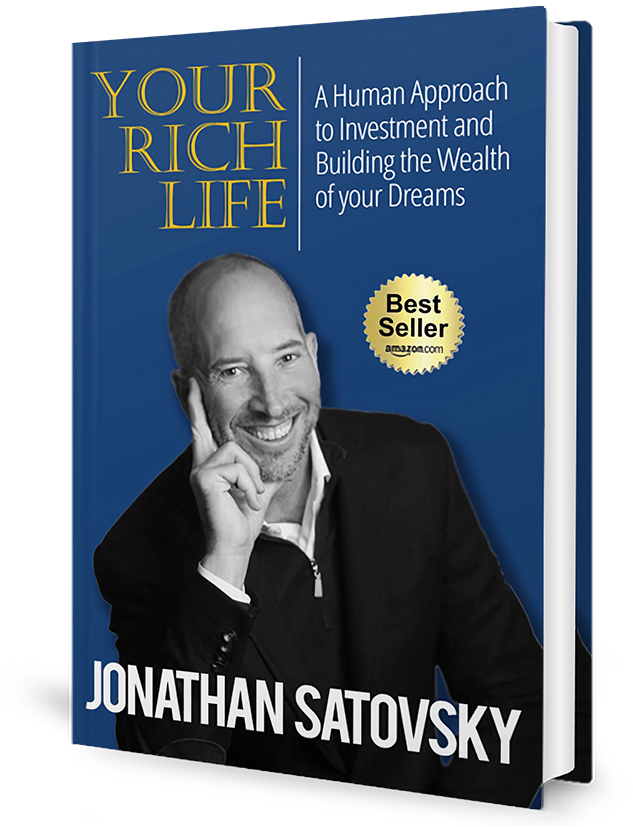

Wealth is the ability to fully experience life.

Unlock the wealth of yourdreams with

"Your Rich Life"

A revolutionary guide to smart investing!

Too many people miss their financial potential due to poor planning and self-sabotage. In “Your Rich Life,” seasoned asset manager and financial planner Jonathan Satovsky offers no-nonsense advice on avoiding these pitfalls and maximizing your lifetime returns.

This book is designed to inspire you to achieve true abundance – a richness that goes beyond the size of your portfolio. It’s your roadmap to the wealth of your dreams. Don’t miss out on this opportunity to transform your financial future!

Wisdom, Wealth and Wellness Podcasts

In this episode of “Seeking Wisdom, Wealth, and Wellness,” host Jonathan Satovsky interviews renowned investor and author Joel Greenblatt. They discuss Greenblatt’s value investing strategies, the importance of patience and discipline, and the behavioral biases that challenge investors. Greenblatt shares insights from his books, reflects on the evolution of his investment approach, and highlights the need for a systematic process. Personal stories and book recommendations round out the conversation, offering listeners practical wisdom for navigating markets and building long-term wealth. The episode emphasizes learning, emotional resilience, and the value of strong relationships in investing.

Full Video Podcast 33:15

Moments with Jonathan

Reflecting on my journey of self-acceptance, I chose to embrace my natural appearance, including my hair loss, instead of resorting to cosmetic enhancements. This decision was pivotal for me. It symbolizes a broader commitment to being true to oneself and prioritizing inner qualities like kindness and love over superficial appearances. This journey highlights the value of authenticity in a world obsessed with external beauty. 0:58

I’ve found that pattern recognition can significantly enhance investment decisions. Identifying familiar market trends based on past experiences has helped me avoid mistakes and seize opportunities. This ability becomes especially invaluable in volatile conditions where traditional investment processes may fall short. For me, it’s about learning from both successes and failures to make more informed decisions. 1:31

In discussing performance anxiety, I realized the importance of authenticity. Early in my career, I often felt anxious about providing the “right” answers. My breakthrough came when I started admitting when I didn’t know something and only spoke within my areas of expertise. This approach alleviated much of my anxiety and built trust with my colleagues. Authenticity not only reduces stress but also fosters genuine connections. 2:01